SILVER MOUNTAIN CONTINUES TO HIT HIGH GRADES AT ITS RELIQUIAS MINE, PERU, AND CUTS 1.45 METRES OF 588 G/T SILVER EQUIVALENT AT THE SACASIPUEDES VEIN AND 1.05 METRES OF 558 G/T SILVER EQUIVALENT AT THE PERSEGUIDA VEIN

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN OR INTO THE UNITED STATES

Key Highlights – Infill and resource expansion drilling at Reliquias

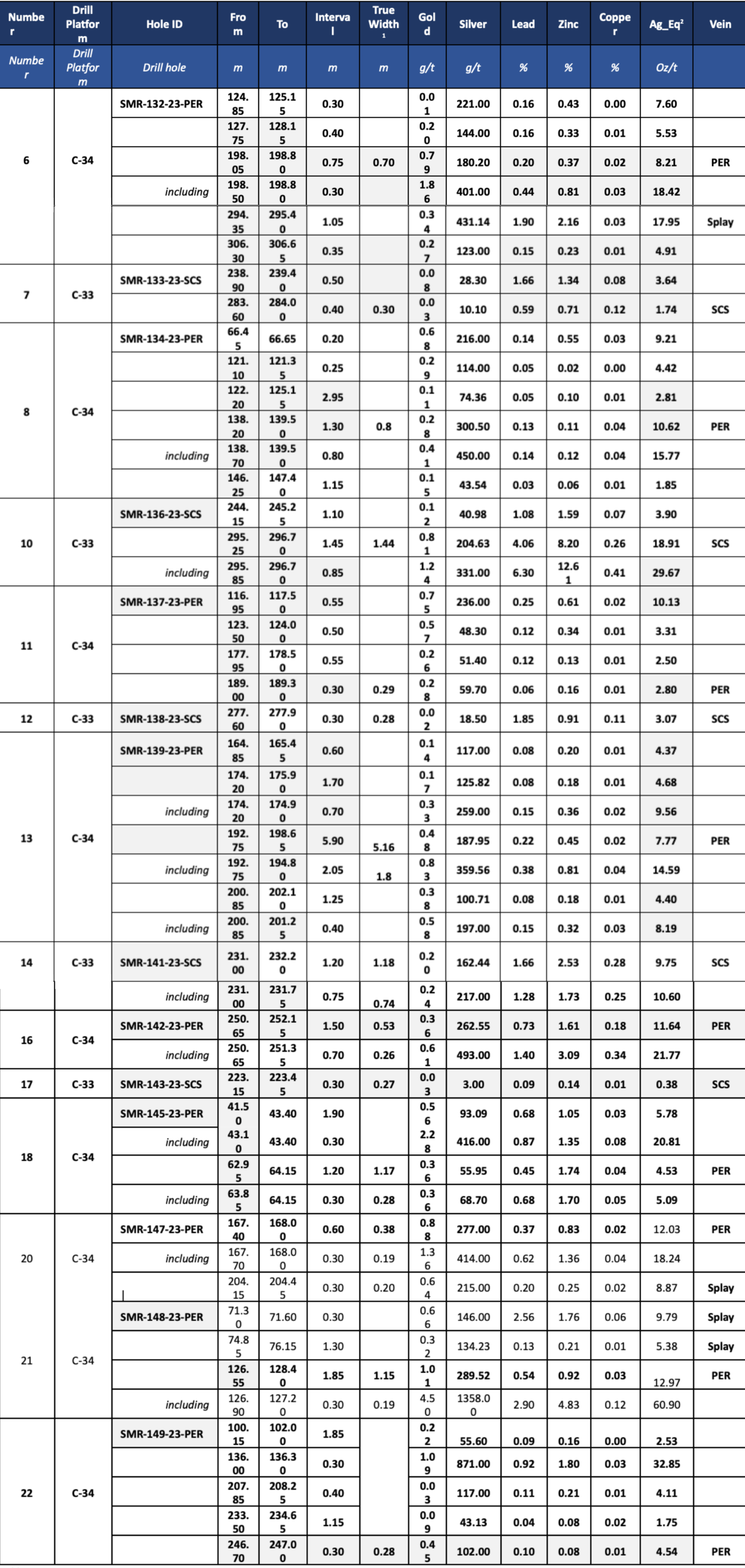

Drill Hole SMR136-23-SCS (SCS vein)

1.45 m @ 205 g/t Ag, 4.06% Pb, 8.20% Zn, 0.26% Cu and 0.81 g/t Au, including

0.85 m @ 331 g/t Ag, 6.30% Pb, 12.61% Zn, 0.41% Cu and 1.24 g/t Au

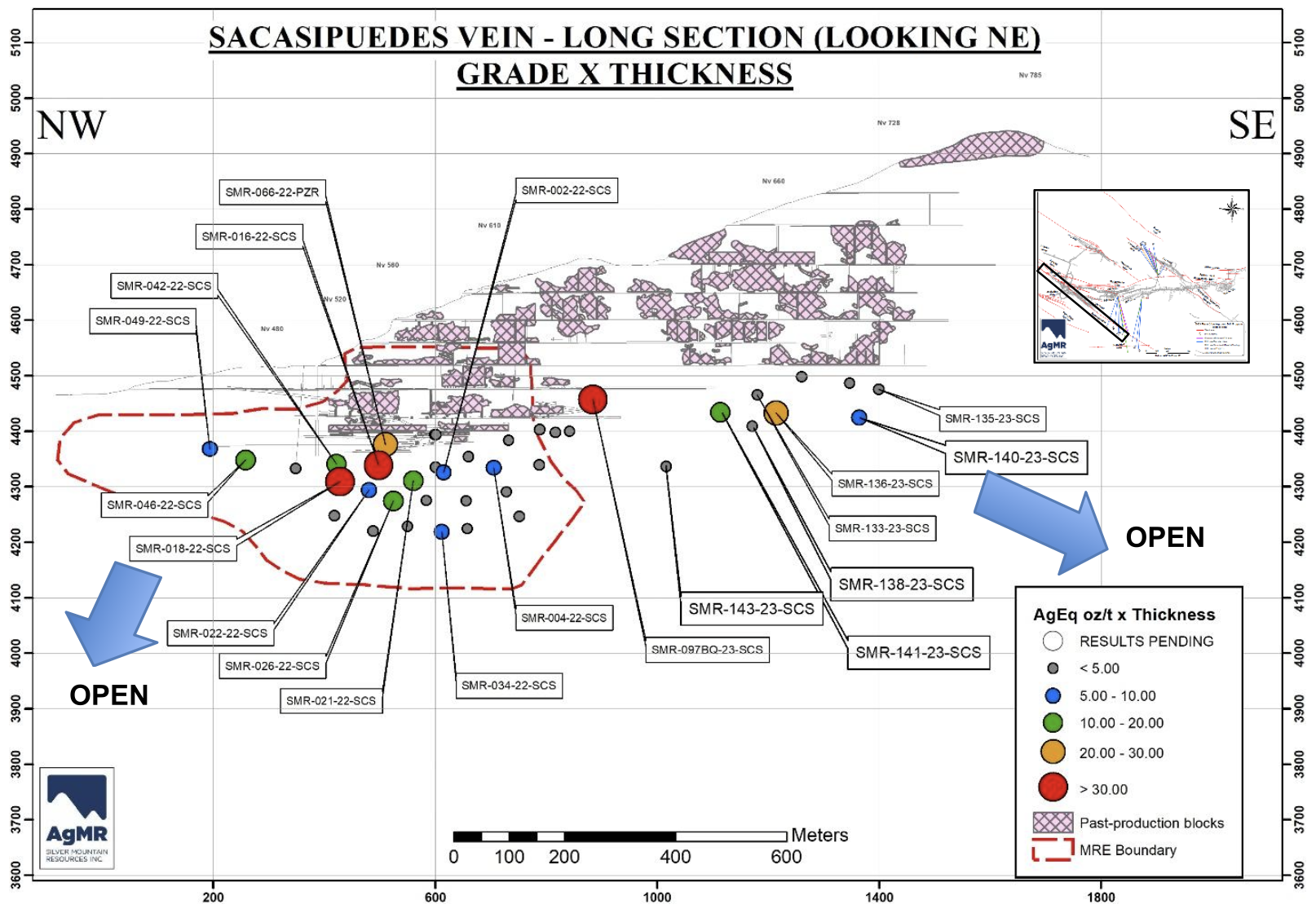

Drill Hole SMR139-23-PER (PER vein)

5.90 m @ 188 g/t Ag, 0.22% Pb, 0.45% Zn, 0.02% Cu and 0.48 g/t Au, including

2.05 m @ 360 g/t Ag, 0.38% Pb, 0.81% Zn, 0.04% Cu and 0.83 g/t Au

Drill Hole SMR132-23-PER (PER vein)

1.05 m @ 431 g/t Ag, 1.90% Pb, 2.16% Zn, 0.03% Cu and 0.34 g/t Au

Drill Hole SMR134-23-PER (PER vein)

1.30 m @ 301 g/t Ag, 0.13% Pb, 0.11% Zn, 0.04% Cu and 0.28 g/t Au, including

0.80 m @ 450 g/t Ag, 0.14% Pb, 0.12% Zn, 0.04% Cu and 0.41 g/t Au

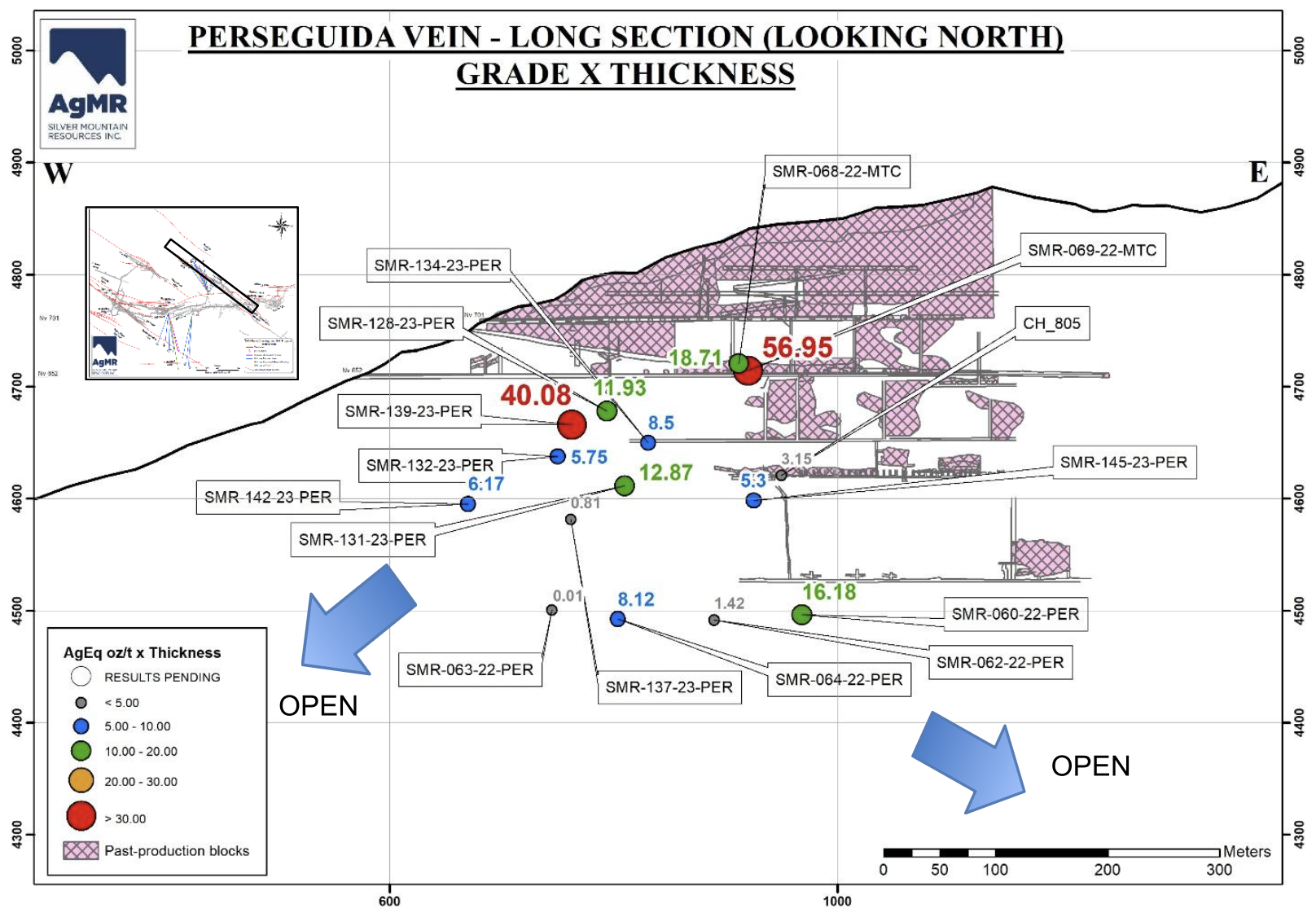

TORONTO, CANADA, Wednesday, October 4, 2023 – Silver Mountain Resources Inc. (“Silver Mountain” or “the Company”) (TSXV: AGMR; OTCQB: AGMRF) is pleased to announce results from fourteen (14) additional drill holes from its ongoing infill and resource expansion program at its 100% owned Reliquias mine, central Peru. All of the holes are part of Phase 2 of its 2023 infill and resource expansion program and are not included in the current mineral resource estimate announced on April 12th, 2023.

Phase 2 of the 2023 drill program consists of 12,500 metres of NQ and HQ drilling aimed at confirming certain high grade areas of the historical mineral resource which was not included in the Company´s current resource estimate (see news release dated April 12th, 2023 ). So far, drilling crews have completed approximately 7,600 metres of this program with two underground rigs, and the Company has received results from 22 drill holes (see also news releases dated July 19th and August 16th, 2023).

Alvaro Espinoza, CEO of Silver Mountain, stated, “We are very happy to see such high grade base metal results from the Sacasipuedes (“SCS”) vein. The Reliquias mine has long been known for hosting very high grades on its multiple mineralized veins, and it is gratifying to confirm such grades with our recent drilling. Hitting 19% of combined zinc and lead grade confirms that some of the highest grade portions of the mineralizaed system remain outside of our current mineral resource base and our drill program is therefore good value for money.”

Mr. Espinoza continued, “Coupled with the recent discovery of the Natividad vein, we feel increasingly confident that our resource expansion drill program will continue to give us pleasant surpirses and allow us to grow the Reliquias resource significantly. Our drilling and mine rehabilitation program continues at full speed and we look forward to updating the market as we receive results.”

Discussion of 2023 Drilling Results

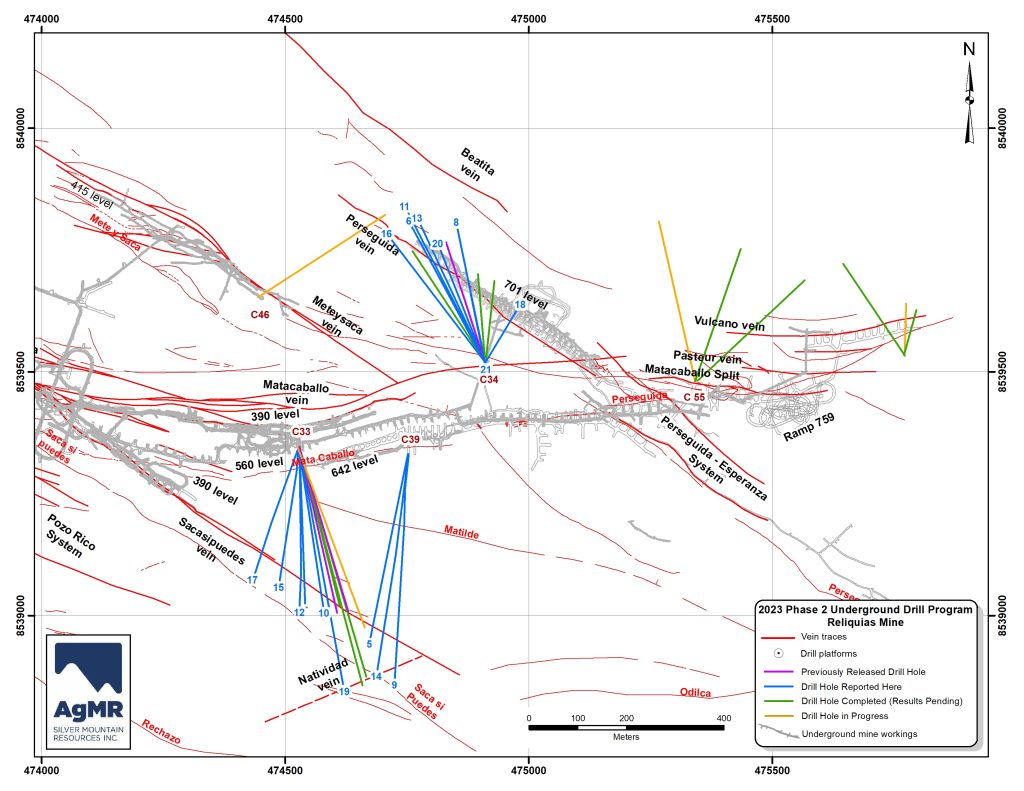

The Company has so far completed 24 drill holes on the Sacasipuedes and Perseguida vein systems from three underground drill platforms, two from Sacasipuedes and one from Perseguida. Details on the location of the underground drill platforms and drill traces are found in Figure 1. Table 1 also shows a summary of the results announced in this news release. Details from all drill holes announced to date will be posted on the Company’s website (https://agmr.ca/ ).

Drilling along the Sacasipuedes vein (“SCS”) has tested its southeast extension, several hundred metres from the limits of the current mineral resource. Figure 2 shows a longitudinal section of the SCS vein with the updated drill results. The best results were obtained in drill hole SMR-136-23-SCS with 1.45 m @ 205 g/t Ag, 4.06% Pb, 8.20% Zn 0.26% Cu and 0.81 g/t Au. Mineralization remain open along strike and at depth, and high grade trend can be identified towards the southeast and at depth near the northwestern extension of the vein.

Drilling along the Perseguida vein (“PER”) has focused along the northwestern extension of the vein, aimed at testing the deeper levels of the vein, beyond the lowest mining levels from the historic mine. The PER vein was not included in the current mineral resource estimate for the Reliquias mine. The latest results show significant silver equivalent grades extending the known mineralization along strike and down dip. Figure 3 shows a longitudinal section of the PER vein showing results from the Company´s drilling and the location of the historic workings. The best results from the PER vein reported here were obtained in drill hole SMR-142-23-PER with 1.50m @ 263 g/t Ag, 0.73% Pb, 1.61% Zn, 0.18% Cu and 0.36 g/t Au. Mineralization remains open along strike and at depth.

The 2023 drill program consists of two phases: an initial 3,500 metre phase using BQ diameter core (now completed); and a second 12,500 meter phase using NQ and HQ diameter core. Full results from the BQ diameter drilling have now been announced (see also March 29th and July 19th news release at https://agmr.ca/news/ ). The second phase of infill drilling started in June 2023 and continues with 3 rigs working in the upper levels of the MTC (Matacaballo), MTS (Meteysaca), PER (Perseguida), and SCS (Sacasipuedes) vein systems, where high grade historical resource blocks remain outside of the current resource estimate. The Company has also recently announced the discovery of the NAT (Natividad) vein. The Company plans to incorporate these high-grade blocks in future resource estimates. Results will be announced as they become available.

On Behalf of the Board of Directors of Silver Mountain Resources Inc.

Alvaro Espinoza, Chief Executive Officer

Qualified Person

Antonio Cruz Bermudez, , P. Geo. Registered Member MAIG is an independent consultant of the Company and the Qualified Person (within the meaning of NI 43-101) responsible for the MRE, has reviewed and approved the scientific and technical information contained in this news release.

About Silver Mountain

Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and currently exploring its 100% owned Castrovirreyna Project, consisting of over 60,000 hectares of highly prospective mineral claims and concessions located in the Huancavelica Region, central Peru. For additional information regarding the Castrovirreyna Project, please refer to the Company’s technical report, titled NI 43-101 Technical Report Mineral Resource Estimate for the Reliquias Mine, Huancavelica- Peru, dated March 27, 2023, effective date March 18, 2023, available at https://sedar.com.

For further information about our drill program, including cross sections of the main veins with drill hole locations, please refer to our corporate presentation, available on our website at www.agmr.ca

For Further Information Contact:

Alvaro Espinoza

Chief Executive Officer

Silver Mountain Resources Inc

82 Richmond Street East

Toronto, ON M5C 1P1

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Sampling, QA/QC, and Analytical Procedures

Silver Mountain follows systematic and rigorous sampling and analytical protocols which meet industry standards. These protocols are summarized below.

All drill holes are diamond core holes with BQ, HQ or NQ core diameters. Drill core is collected at the underground drill site where recovery measurements are taken before the core is transported by truck to the core logging facility at the Caudalosa Grande mine camp, where it is photographed and geologically logged. The core is then cut in half with a diamond saw blade with half the sample retained in the core box for future reference and the other half placed into a pre-labelled plastic bag, sealed with a plastic zip tie, and identified with a unique sample number. The core is typically sampled over a 1 – 2 metre sample interval unless the geologist determines the presence of an important geological contact. The bagged samples are then stored in a secure area pending shipment to a certified laboratory sample preparation facility.

Rock channel samples were collected with an electric percussion hammer and do not exceed 1.0 m in length. Channels are broken at obvious geologic boundaries to correctly separate rock types and mineralization styles. The sample bags were sealed with a plastic zip tie and identified with a unique sample number, pending shipment to a certified laboratory sample preparation facility.

Samples are sent by batch to the ALS laboratory and Certimin in Lima for assay. Silver Mountain independently inserts certified control standards, fine and coarse blanks, and duplicates into the sample stream to monitor data quality. These standards are inserted “blindly” to the laboratory in the sample sequence prior to departure from the core storage facilities. At the laboratory, samples are dried, crushed, and pulverized and then analyzed using a fire assay-AA finish analysis for gold and a full multi-acid digestion with ICP-AES analysis for other elements. Samples with results that exceed maximum detection values for the main elements of interest (Ag, Zn, Pb, Cu) are re-analyzed using precise ore-grade ICP analytical techniques, while high gold values are re-analyzed by fire assay with a gravimetric finish.

Forward Looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements“) that relate to Silver Mountain’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond Silver Mountain’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the factors set forth under “Caution Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Information Form dated August 14, 2023, and other disclosure documents available on the Company’s profile on SEDAR+ at www.sedarplus.ca. Silver Mountain undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Silver Mountain to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.