SILVER MOUNTAIN REPORTS NEW UNDERGROUND CHANNEL SAMPLING RESULTS FROM THE SACASIPUEDES AND MATACABALLO VEINS, RELIQUIAS MINE

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN OR INTO THE UNITED STATES

Highlights:

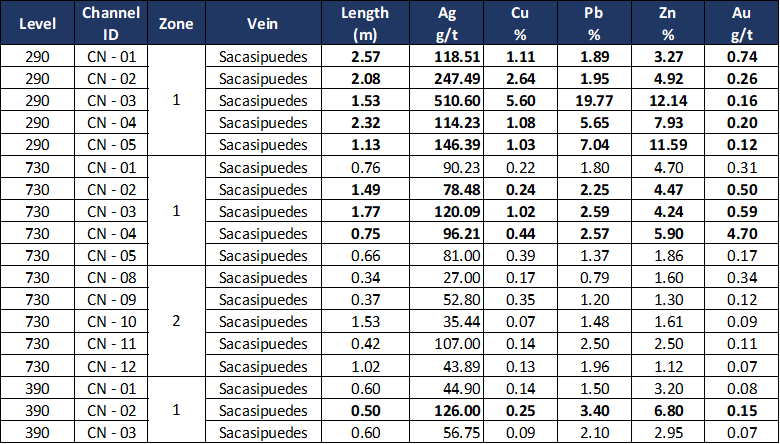

- 1.53m @ 510.60 g/t Ag, 19.77% Pb, 12.14% Zn, 5.60% Cu, and 0.16 g/t Au (SCS vein)

- 2.08m @ 247.49 g/t Ag, 1.95% Pb, 4.92% Zn, 2.64% Cu, and 0.26 g/t Au (SCS vein)

- 2.32m @ 114.23 g/t Ag, 5.65% Pb, 7.93% Zn, 1.08% Cu, and 0.20 g/t Au (SCS vein)

- 0.81m @ 231.06 g/t Ag, 4.50% Pb, 8.30% Zn, 0.79% Cu, and 2.79 g/t Au (MTC vein)

- 1.52m @ 231.72 g/t Ag, 8.25% Pb, 6.92% Zn, 0.96% Cu, and 0.32 g/t Au (MTC vein)

Toronto, Ontario, May 09, 2023 – Silver Mountain Resources Inc. TSXV:AGMR | OTCQB:AGMRF | BVL:AGMR (“Silver Mountain“, “AGMR” or the “Company“) is pleased to announce new results from underground channel sampling at the Reliquias silver mine in Huancavelica, central Peru. To complement the drill campaigns and to facilitate the conversion of additional historic resources into an updated National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant mineral resource in Q1 2024, an extensive underground mapping and sampling program is continuing at Reliquias. Several existing drifts and sublevels were mapped and systematically sampled along channels cut across the exposed veins.

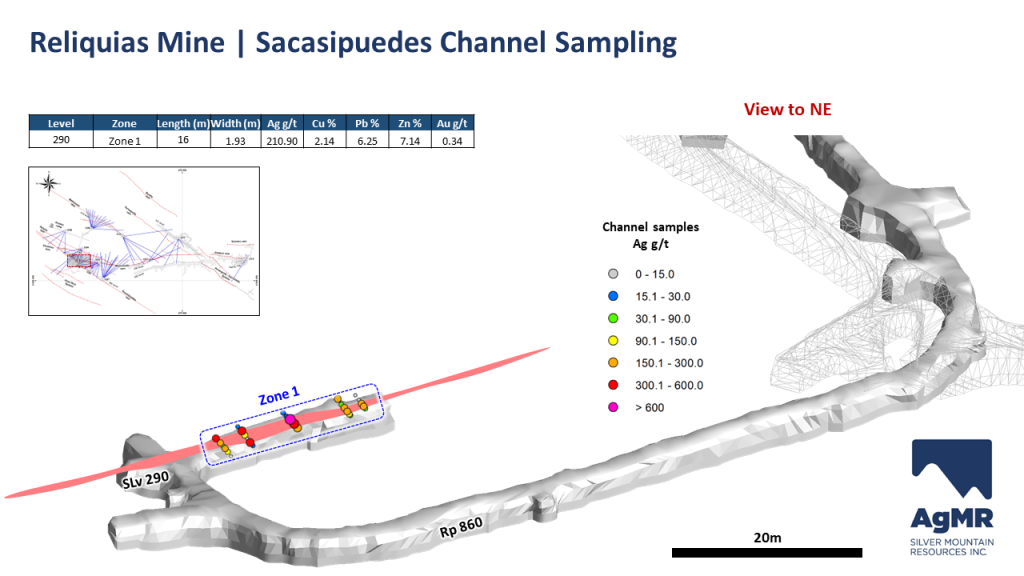

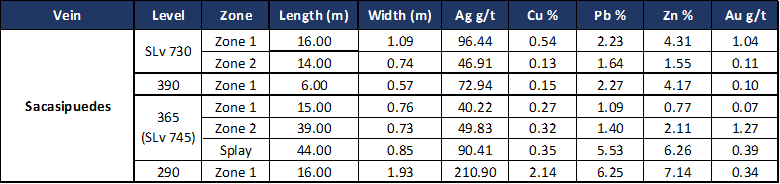

The best channel results were obtained from the Sacasipuedes structure on sublevel 290, which is currently accessible over 16 m of strike length (Fig.1 and Table 1). The mineralization is well developed over the exposed shoot, with the vein thickness averaging 1.93 m. The weighted average assay results returned 210.90 g/t Ag, 6.25% Pb, 7.14% Zn, 2.14% Cu, and 0.34 g/t Au.

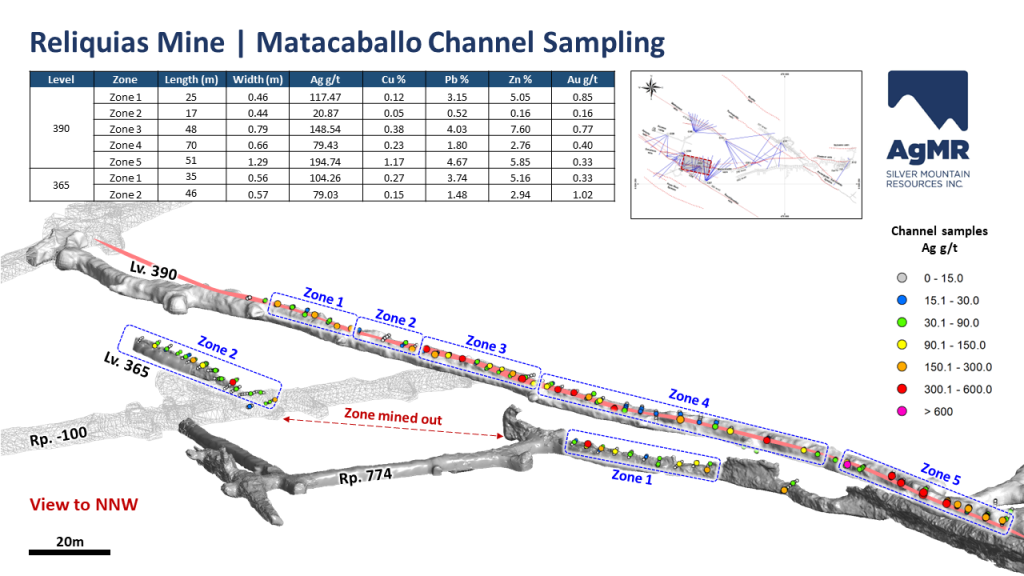

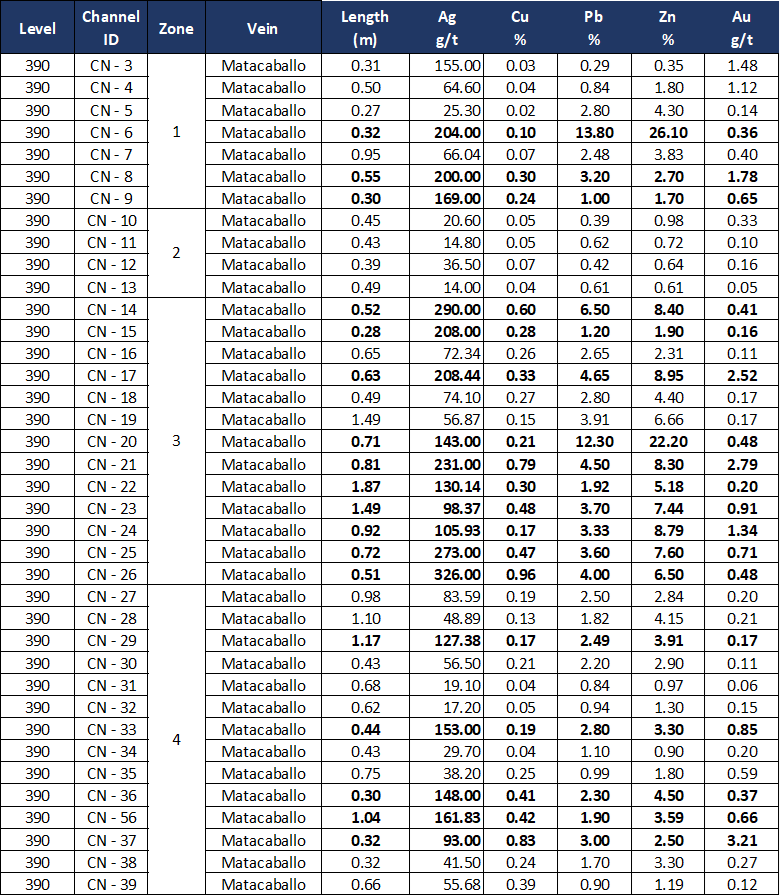

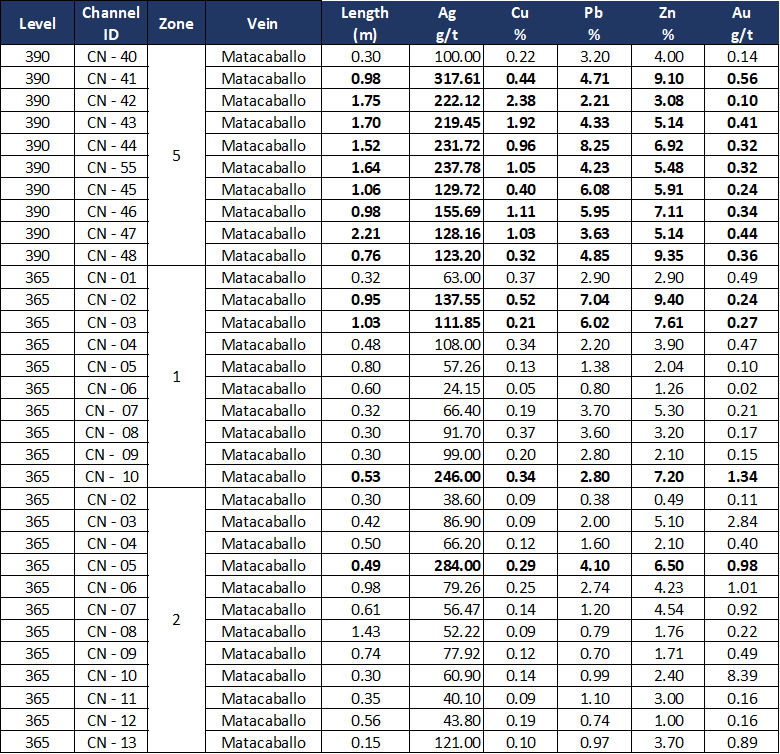

Along the sampled levels of the Matacaballo vein, the mineralization is best developed in Zone 5 on Level 390, which extends over 51 m along strike, with a weighted average of 194.74 g/t Ag, 4.67% Pb, 5.85% Zn, 1.17% Cu, and 0.33 g/t Au over an average vein width of 1.29 m (Fig.2 and Table 2).

Sacasipuedes Vein (SCS)

Fig. 1 displays the underground channel sampling results for the Sacasipuedes vein on sublevel 290 situated approximately 60 m below the main haulage level 390. On this and other sampled mine levels, various zones returned high-grade Pb and Zn grades, moderately high Ag and Cu values, and promising Au values (8 individual channel samples above 1 g/t Au, with highs of 13.75 and 15.55 g/t Au).

Matacaballo Vein (MTC)

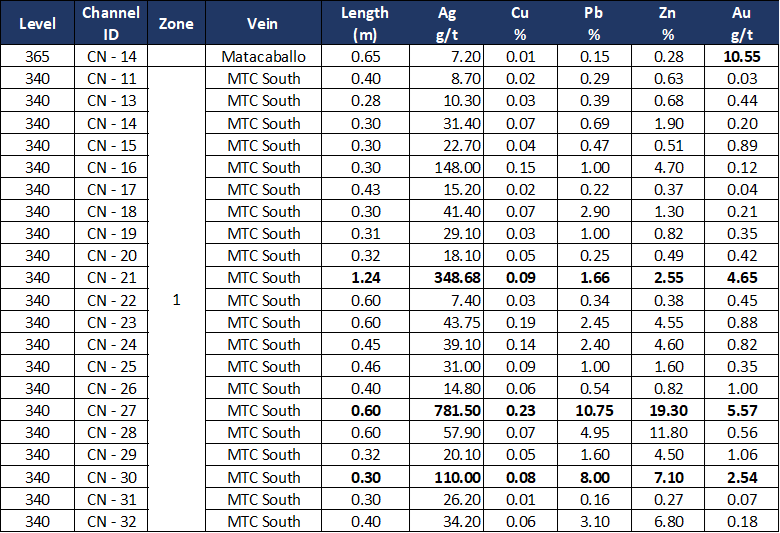

On levels 390 and 365 of the Matacaballo vein, various zones of well-developed mineralization are exposed over approximately 210 m in a horizontal direction and additionally 25 m vertically. The central part of Level 365 was exploited in the past (see Fig.2), indicating prior occurrence of economic mineralization. The underground sampling results from the Matacaballo vein confirm the continuity of high- to medium-grade polymetallic mineralization within the structure, with significant concentrations of silver (Ag), lead (Pb), zinc (Zn), and copper (Cu). Gold grades, ranging on average between 0.16 g/t and 1.02 g/t on both levels 365 and 390, correlate well with previously reported values from Sublevel 735-1 located above and to the east (see news release December 7, 2022). To highlight the consistency of this vein system, the grades and widths of channels were averaged over each of the seven zones shown in Fig. 2 (see Tab. 2 for results).

Alvaro Espinoza, CEO, commented: “We are delighted about these sampling results, proving moderate- to high-grade polymetallic mineralization over several levels in two of our most important vein structures. The sampled sublevels are located close to existing infrastructure, most significantly the main haulage level 390. The grades encountered on Level 290 of the Sacasipuedes vein over the exposed strike length of 16 m, with an average vein thickness of 1.93 m averaging 210.9 g/t Ag, 6.25% Pb, 7.14% Zn, 2.14% Cu, and 0.34 g/t Au, are especially promising. The 290 level is currently the lowest working of the Reliquias mine, which emphasizes the potential of adding high-grade mineralization in this structure further towards depth.”

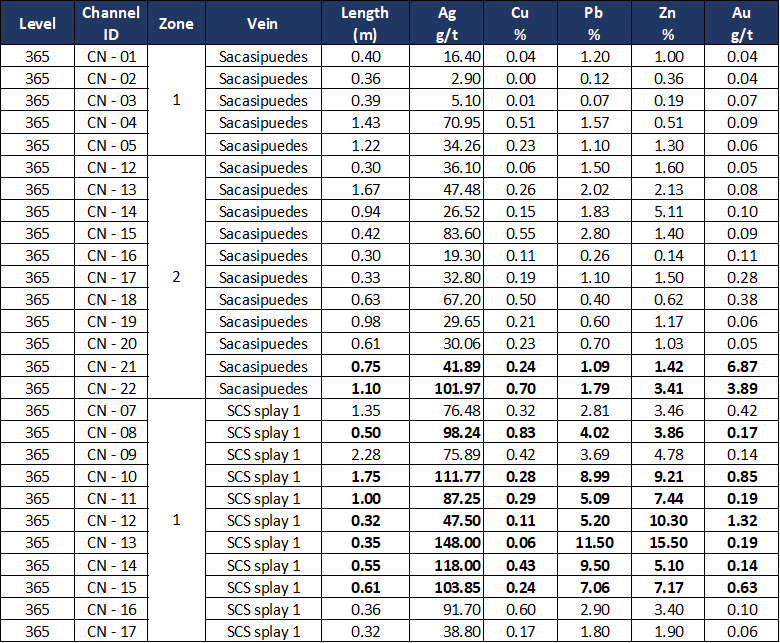

The following tables provide more details regarding the channel sample results reported today from the Sacasipuedes and Matacaballo vein structures. In total, geochemical assays have been received for 1,007 rock channel samples taken from Levels 390, 365, 290, and adjacent workings of the Sacasipuedes vein and from Levels 390, 365, and 340 of the Matacaballo vein (Tables 3 and 4).

On Behalf of the Board of Directors of Silver Mountain Resources Inc.

Alvaro Espinoza, Chief Executive Officer

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Antonio Cruz, an independent consultant of the Company and a Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Silver Mountain

Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and undertake exploration activities at its prospective silver camps at the Castrovirreyna Project in Huancavelica, Peru.

For additional information in respect of the Castrovirreyna Project, please refer to the Company’s technical report, titled National Instrument 43-101 Technical Report—Castrovirreyna Project, Peru, dated October 6, 2021, amended November 18, 2021, effective date August 17, 2021, available on the Company’s profile on www.sedar.com. A new technical report, titled NI 43-101 Technical Report Mineral Resource Estimate for the Reliquias Mine, Huancavelica- Peru, dated March 28, 2023, effective date March 18, 2023, will be made available shortly at https://sedar.com.

Silver Mountain’s subsidiary Sociedad Minera Reliquias S.A.C. owns 100% of its concessions and holds more than 40,000 hectares in the district of Castrovirreyna, Huancavelica, Peru.

For Further Information Contact:

Alvaro Espinoza

CEO

Silver Mountain Resources Inc

82 Richmond Street East

Toronto, ON M5C 1P1

www.agmr.ca

Sampling Methodology, QA/QC and Analytical Procedures

Silver Mountain follows systematic and rigorous sampling and analytical protocols which meet industry standards. These protocols are summarized below.

Samples were taken using an electric percussion hammer to produce a channel perpendicular across the veins and mineralized structures. By cutting a continuous channel approximately 3-5 cm deep by 10 cm wide, the channel samples essentially equal a drill core in their significance for future resource estimation. Where the structure is exposed along the back of the drift, channels were cut across the vein systematically every 4 m. Channel lengths range between 0.15 m and 2.57 m.

All channel samples were collected with an electric percussion hammer and do not exceed 1.0 m in length. Channels are broken at obvious geologic boundaries to correctly separate rock types and mineralization styles. The sample bags were sealed with a plastic zip tie and identified with a unique sample number, pending shipment to a certified laboratory sample preparation facility. Samples are sent by batch to the ALS laboratory in Lima for assaying. Silver Mountain independently inserts certified control standards (purchased from OREAS and Target Rocks), fine and coarse blanks, and duplicates into the sample stream to monitor data quality. These standards are inserted “blindly” to the laboratory in the sample sequence prior to departure from the storage facilities. At the laboratory samples are dried, crushed, and pulverized and then analyzed using a fire assay-AA finish analysis for gold and a full multi-acid digestion with ICP-AES analysis for other elements. Samples with results that exceed maximum detection values for the main elements of interest (Ag, Zn, Pb, Cu, Au) are re-analyzed using precise ore-grade ICP analytical techniques, while high gold values are re-analyzed by fire assay with a gravimetric finish.

Forward Looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements“) that relate to Silver Mountain’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond Silver Mountain’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the factors set forth under “Forward-Looking Statements” and “Risk Factors” in the Company’s final prospectus dated January 26, 2022, and other disclosure documents available on the Company’s profile at www.sedar.com. Silver Mountain undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Silver Mountain to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.