SILVER MOUNTAIN DELIVERS INITIAL NI 43-101 COMPLIANT MINERAL RESOURCE ESTIMATE FOR RELIQUIAS MINE

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN OR INTO THE UNITED STATES

Toronto, Ontario, April 12, 2023 – Silver Mountain Resources Inc. TSXV:AGMR | OTCQB:AGMRF | BVL:AGMR (“Silver Mountain“, “AGMR” or the “Company“) is pleased to provide a first National Instrument 43-101 compliant mineral resource estimate (“MRE”) for its 100% owned Reliquias mine in Huancavelica, central Peru.

Highlights

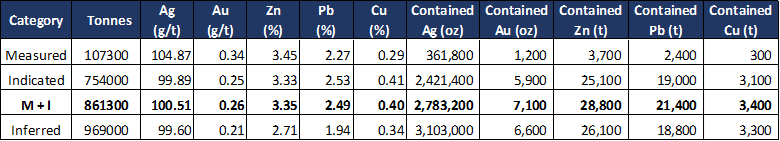

- Measured & Indicated Resources: 861,300 tons containing 2.78 million ounces of silver, 7,100 ounces of gold, 28,800 tons of zinc, 21,400 tons of lead, and 3,400 tons of copper

- Inferred Resources: 969,000 tons containing 3.10 million ounces of silver, 6,600 ounces of gold, 26,100 tons of zinc, 18,800 tons of lead, and 3,300 tons of copper

- Mineralization in all three main vein structures is open along strike and at depth, showing excellent potential to grow with future drilling and underground sampling.

Alvaro Espinoza, CEO, commented: “We are very pleased to deliver on one of the milestones outlined for early 2023. Within a short timeframe and in a cost-effective manner, our team has added substantial value to the Reliquias mine. We are delighted to announce that NI 43-101 compliant mineral resources now include 2.78 Moz Ag in the measured & indicated category and 3.10 Moz Ag in the inferred category, plus significant amounts of base metals. Our ongoing 2023 drill program already indicates strong growth potential beyond this maiden mineral resource estimate, to be incorporated in an updated estimate as part of the PEA planned for Q3 2023, advancing the Company closer to production.”

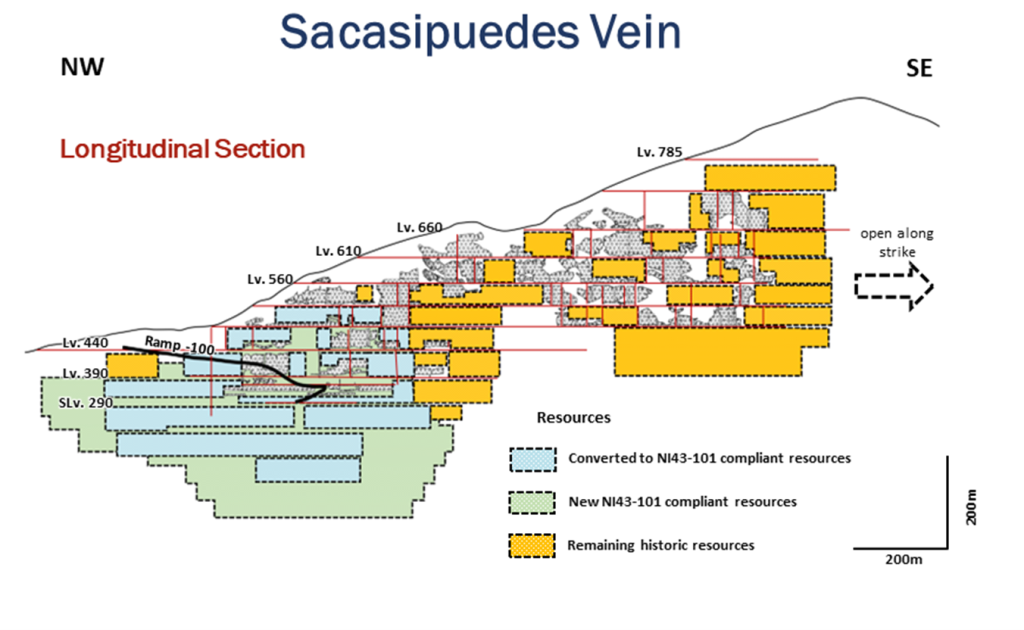

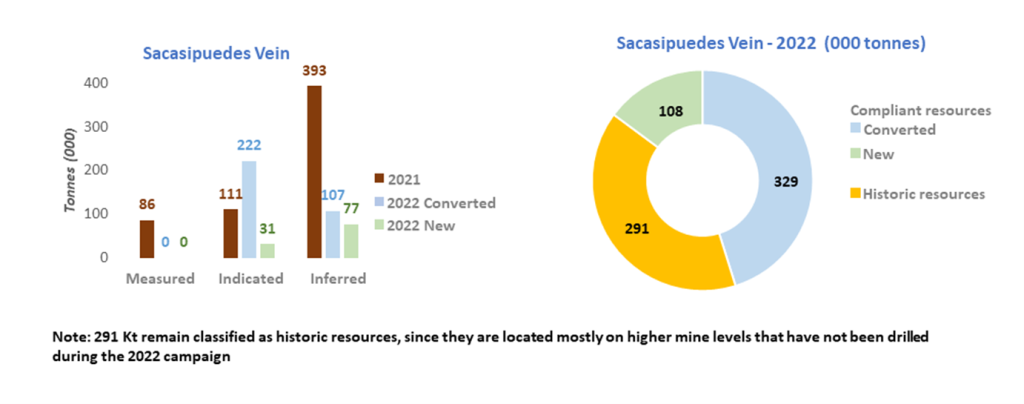

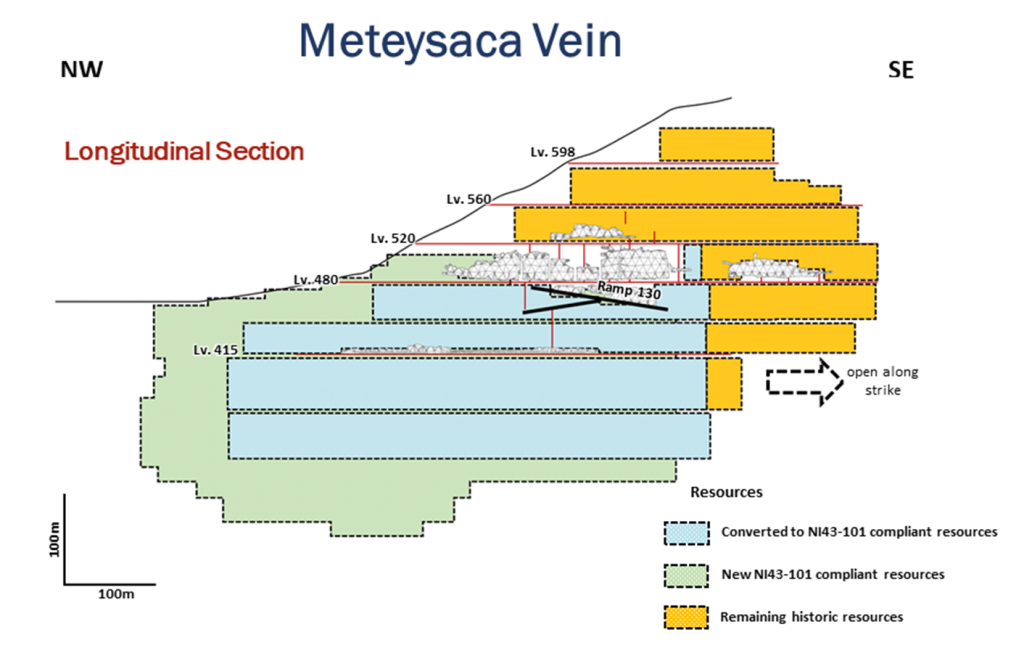

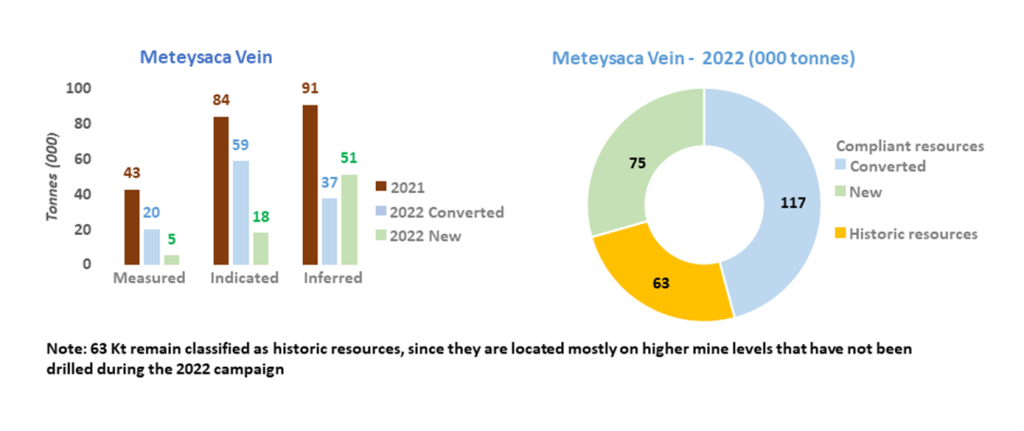

Torsten Danne, Director of Exploration, added: “Our phase I drilling was highly successful in confirming and expanding historic resources in three of the main veins. With drilling and underground sampling of several other known vein structures currently underway, we see excellent potential to further expand the mineral resources at Reliquias. Additional opportunities to grow high-grade silver resources exist through the ongoing rehabilitation of upper mine levels, which will enable us to evaluate zones of remaining historic resources (see Fig.2 to 4).”

A maiden NI 43-101 compliant Mineral Resource Estimate

This MRE is based on 60 diamond drill holes, with a total of 13,640.80 metres, completed by the Company between April and October 2022. The MRE was prepared using assays sourced from a total of 4,672 core samples (including QA/QC samples) with interval lengths varying between 0.5 and 1.5 m. Additionally, the analyses of 1,416 rock samples (including QA/QC samples) taken during systematic sampling of underground workings were included in the database to calculate the mineral resources. The MRE was independently prepared by RREMIN S.A.C. (RREMIN) in accordance with NI 43-101, with an effective date of March 18, 2023, and using a database current as of December 15, 2022. The full technical report, which is being prepared in accordance with NI 43-101 will be filed on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days of the date of this news release.

Table 1: Mineral Resource Estimate for the Reliquias mine

Notes:

-

Mineral Resources described above have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)) Standards on Mineral Resources and Mineral Reserves, 2014.

-

The independent qualified persons responsible for the preparation of the technical report supporting the MRE are Antonio Cruz Bermudez, P.Geo., member of the Australian Institute of Geoscientists (member #7065), and Gerardo Acuña, P.Eng., fellow of the Australasian Institute of Mining and Metallurgy (member #337049, CP Mining), both of RREMIN S.A.C., Lima, Peru.

-

Mineral Resources have an effective date of March 18, 2023, using a database current as of December 15, 2022. Antonio Cruz Bermudez is the independent qualified person responsible for the Mineral Resources estimate.

-

The Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

-

There is no certainty that all or part of the estimated Mineral Resources will be converted to Mineral Reserves.

-

Mineral Resources are reported at US$36.34 NSR cut-off for the polymetallic veins and the long-term prices of the metals considered were Silver US$ 23.29 /oz, Copper US$ 9,419 /t, Zinc US$ 2,813 /t, and Lead US$ 2,188 /t.

-

Metallurgical recoveries for polymetallic veins are based on historical recovery by the previous operator CMC: Ag= 73.00%, Pb= 83.00%, Zn= 71.00%, Cu= 85.00%. Initial metallurgical test work carried out by Silver Mountain in 2022 indicates potential to achieve significantly higher recoveries.

-

The average density was calculated from drill core samples for all the veins and the average value used for the calculation of tonnage is 2.76 t/m3.

-

The MRE is based on block model with a block size of 2.0 m x 2.0 m x 2.0 m.

-

Tonnage has been expressed in the metric system, and the precious metal content (Ag, Au) has been expressed in troy ounces.

-

Mineral Resource tonnes are rounded to the nearest 1,000 tonne and precious metal content has been rounded to the nearest 1,000 oz. Totals may not add due to rounding.

-

The reported Mineral Resources are not diluted.

-

The Mineral Resources reported do not include mined-out areas.

-

Antonio Cruz Bermudez is not aware of factors or issues that could materially affect the mineral resource estimate other than normal risks faced by mining projects, in terms of environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant factors, and additional risk factors regarding inferred resources.

The estimated tonnage considered for the MRE is contained in five main veins (Matacaballo, Sacasipuedes, Meteysaca, Ayayay, and Sorpresa) and 14 vein splays. The average true thickness of these structures varies between 0.1 and 2.0 m. The NI 43-101 compliant resources reported in this release are located predominantly below Level 480 of the Reliquias deposit, due to restricted accessibility of underground workings during the 2022 drilling campaign.

Wireframes representing mineralization were produced from plans, core logging, systematic sections, underground mapping, and interpretations. The domains have been defined as mineralized structures based on the continuity of Ag-Pb-Zn-Cu-Au mineralization, represented by the five mentioned veins and associated secondary structures. Assay capping thresholds were chosen based on probability and variance plots and vary between different structures. The block model was constructed using 2 m x 2 m x 2 m blocks, based on the appropriate selective mining unit for mineralized structures at Reliquias. Metal grades were interpolated with 1 m composites using Ordinary Kriging (OK) and Nearest Neighbour (NN) methods. The classification of the resources is based on qualitative characteristics and the distance to drilling / sampling.

Discussion of the results of the Mineral Resource Estimate

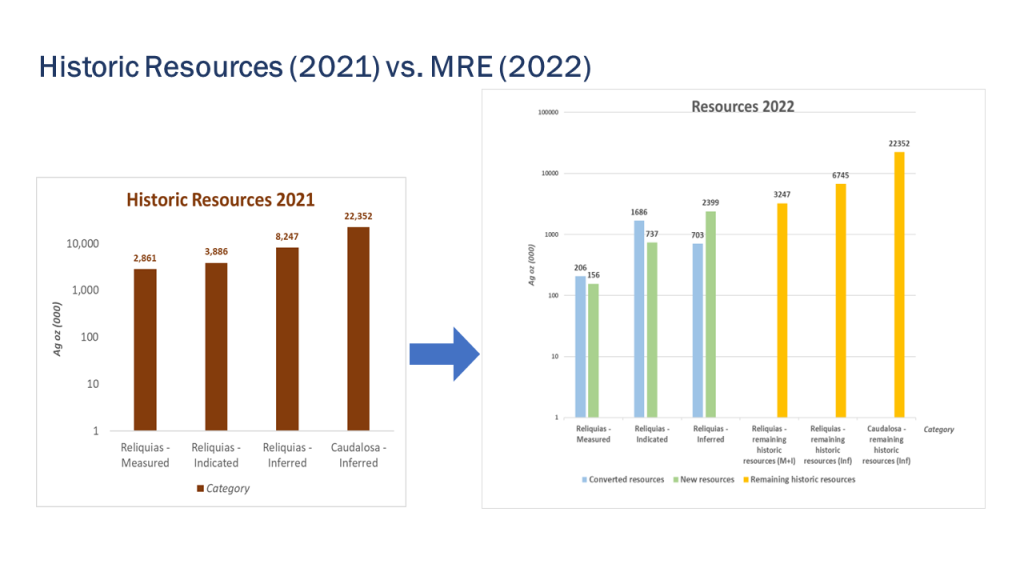

In the 2021 NI 43-101 Technical Report of the Castrovirreyna project [1], historic resources were calculated for the Reliquias and the Caudalosa mine (Fig.1, graph on left side)[2]. The 2022 exploration campaign focussed on the Reliquias mine, successfully converting a significative percentage of the historic resources into NI 43-101 compliant mineral resources. Furthermore, the drilling and sampling program delineated additional resources at depth and to a lesser extent along strike of the three main veins. The results reported in today’s new release include both converted and new resources (Fig.1, graph on right side).

Areas of high-grade mineralization remain along the upper mine levels at Reliquias, categorized as historic resources in the 2021 Technical report (Fig.1, graph on right side). Likewise, more than 22.3 Moz of Ag plus significant amounts of base metals remain as historical resources in the Caudalosa mine, which has not been included in the rehabilitation work so far.

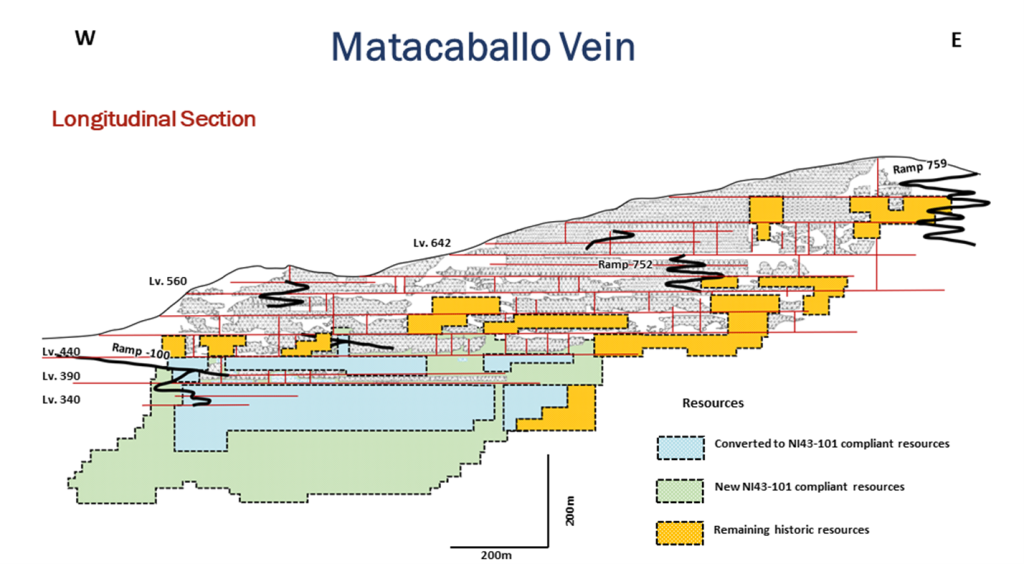

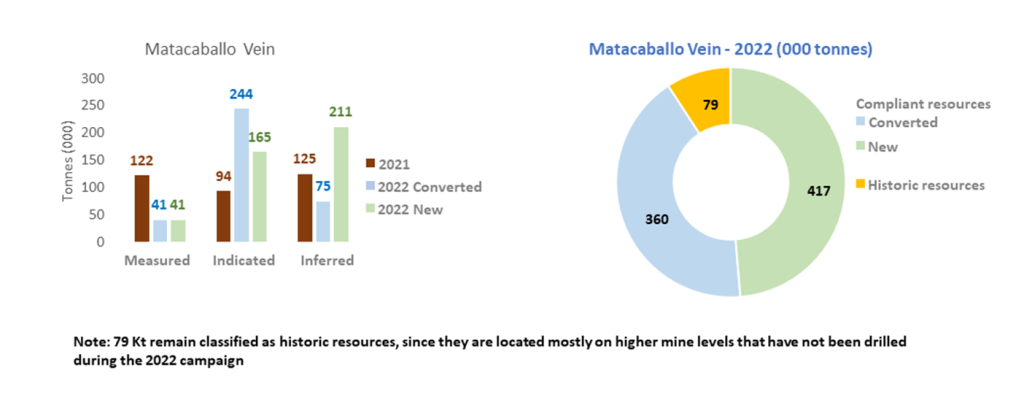

Based on a thorough review of the results of the MRE presented in this release, Fig. 2 to 4 indicate in detail the areas of converted resources and newly added resources for each of the main vein structures. As expected, by drilling mostly from Levels 390 and 415 of the Reliquias mine, a considerable amount of mineralized material previously classified as historic resources was converted into NI 43-101 compliant mineral resources. New mineral resources were added at depth and along strike at all three veins. As shown in Fig.2, the drilling campaign was especially successful in that regard at the Matacaballo vein, converting 360,000 t into compliant resources and identifying another 417,000 tons of new mineral resources. This structure now reports 491,000 tons in the measured and indicated category, with 286,000 tons in the inferred category.

At the Sacasipuedes vein, the cross section (Fig.3) shows that larger zones on the southeastern side of the structure, containing 291,000 tons of historic resources, remain to be evaluated and re-categorized through future exploration. Converted and newly added resources extend for approximately 300 m vertically below Level 440, holding 253,000 tons of indicated and 184,000 tons of inferred resources.

At the Meteysaca structure (Fig.4), the drilling and underground sampling campaign effectively converted high-grade silver-polymetallic resources below Level 480, while also increasing the resources along strike and towards depth. Measured and indicated resources within the Meteysaca vein amount to 102,000 tons, whereas inferred resources reach 88,000 tons.

[1] For additional information regarding the historical resources of the Castrovirreyna Project, please refer to the Company’s technical report, titled National Instrument 43-101 Technical Report—Castrovirreyna Project, Peru, dated October 6, 2021, amended November 18, 2021, effective date August 17, 2021, available on the Company’s profile on www.sedar.com.

[2] (i) Historical resource estimates have been classified in accordance with the CIM Definition Standards; (ii) Historical resource estimates are not Mineral Reserves or Mineral Resources and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimates; (iii) Information is as of July, 2019 Source: Sociedad Minera Reliquias SAC, the information is based on RM-Master Pro Quality, C. Rodriguez, Abril 2019; RM-Master Pro Quality, C. Rodriguez, Jul19; (iv) Antonio Cruz Bermudez, a “qualified person” (as defined in NI 43-101) considers that the historical resource estimates are relevant for the proper understanding of the Castrovirreyna Project and additional exploration, including drilling, could be needed to verify the historical estimate as current Mineral Resources; (v) A qualified person has not done sufficient work to classify the historical estimate as current Mineral Resources or Mineral Reserves; and (vi) The Company is not treating the historical estimate as current Mineral Resources or Mineral Reserves.

On Behalf of the Board of Directors of Silver Mountain Resources Inc.

Alvaro Espinoza, Chief Executive Officer

Qualified Person

Antonio Cruz Bermudez, an independent consultant of the Company and the Qualified Person (within the meaning of NI 43-101) responsible for the MRE, has reviewed and approved the scientific and technical information contained in this news release.

About Silver Mountain

Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and undertake exploration activities at its prospective silver camps at the Castrovirreyna Project in Huancavelica, Peru.

For additional information in respect of the Castrovirreyna Project, please refer to the Company’s technical report, titled National Instrument 43-101 Technical Report—Castrovirreyna Project, Peru, dated October 6, 2021, amended November 18, 2021, effective date August 17, 2021, available at https://sedar.com.

For further information about our drill program, including cross sections of the main veins with drill hole locations, please refer to our corporate presentation, available on our website at www.agmr.ca

Silver Mountain’s subsidiary Sociedad Minera Reliquias S.A.C. owns 100% of its concessions and holds more than 39,000 hectares in the district of Castrovirreyna, Huancavelica, Peru.

For Further Information Contact:

Alvaro Espinoza

Chief Executive Officer

Silver Mountain Resources Inc

82 Richmond Street East

Toronto, ON M5C 1P1

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Sampling, QA/QC, and Analytical Procedures

Silver Mountain follows systematic and rigorous sampling and analytical protocols which meet industry standards. These protocols are summarized below.

All drill holes are diamond core holes with HQ or NQ core diameters. Drill core is collected at the underground drill site where recovery measurements are taken before the core is transported by truck to the core logging facility at the Caudalosa Grande mine camp, where it is photographed and geologically logged. The core is then cut in half with a diamond saw blade with half the sample retained in the core box for future reference and the other half placed into a pre-labelled plastic bag, sealed with a plastic zip tie, and identified with a unique sample number. The core is typically sampled over a 1 – 2 metre sample interval unless the geologist determines the presence of an important geological contact. The bagged samples are then stored in a secure area pending shipment to a certified laboratory sample preparation facility.

Rock channel samples were collected with an electric percussion hammer and do not exceed 1.0 m in length. Channels are broken at obvious geologic boundaries to correctly separate rock types and mineralization styles. The sample bags were sealed with a plastic zip tie and identified with a unique sample number, pending shipment to a certified laboratory sample preparation facility.

Samples are sent by batch to the ALS laboratory in Lima for assay. Silver Mountain independently inserts certified control standards, fine and coarse blanks, and duplicates into the sample stream to monitor data quality. These standards are inserted “blindly” to the laboratory in the sample sequence prior to departure from the core storage facilities. At the laboratory, samples are dried, crushed, and pulverized and then analyzed using a fire assay-AA finish analysis for gold and a full multi-acid digestion with ICP-AES analysis for other elements. Samples with results that exceed maximum detection values for the main elements of interest (Ag, Zn, Pb, Cu) are re-analyzed using precise ore-grade ICP analytical techniques, while high gold values are re-analyzed by fire assay with a gravimetric finish.

Forward Looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements“) that relate to Silver Mountain’s current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”, “plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”) are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond Silver Mountain’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the factors set forth under “Forward-Looking Statements” and “Risk Factors” in the Company’s final prospectus dated January 26, 2022, and other disclosure documents available on the Company’s profile at www.sedar.com. Silver Mountain undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Silver Mountain to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.