Why Millennials and Gen-Z Should Invest in Silver

Why Millennials and Gen-Z Should Invest in Silver

You don’t have to be a skilled investor to know that precious metals offer an effective hedge against inflation. Millennials and Gen-z who have struggled to save due to outstanding student debt are beginning to put their money in gold and silver mining stocks to help build a portfolio as part of planning for their future amid changing job conditions. After weathering the pandemic and market turbulence, more and more millennials are prioritizing long-term, low-risk investments. The past two years served as reminders that fiat currency is at risk of losing value due to erratic economic downturns, social and political unrest, inflation, and other factors that have a substantial negative impact on purchasing power. Silver investment products, such as silver mining stocks, silver ETFs, and silver bullion, can help diversify your portfolio and make financial freedom more attainable for millennials. And it doesn’t just stop at silver — palladium, gold, and platinum also serve millennials well, especially with growing demand from the tech sectors.

Need more convincing? This guide will explain why silver and other precious metals retain their purchasing power and how it even increases over time.

Silver stocks can help hedge against financial uncertainty.

Out of all the generations at the time, the global recession in 2008 hit Millennials particularly hard. Many recently graduated millennials faced with job instability on top of student debt. As economic recessions are unavoidable, rising inflation rates during hard times can swiftly devalue any money you’ve put away in an everyday savings account (with interest rates often lower than 1%). However, the values of precious metals are known to hold their intrinsic value throughout global crises and have an inverse relationship to currencies.

It wasn’t long ago when countries were on the verge of economic collapse due to the COVID-19 pandemic. And many are still recovering as uncertainty surrounding the virus still looms. If you’ve paid attention to the markets over the past two years, you might have noticed that silver and other precious metals performed well compared to the rest of the market and fiat currency.

Internationally recognized

Silver and other precious metals like it have a historical value that has allowed them to remain valuable over time. Even though gold is no longer used to support international currencies (i.e. the gold standard), precious metals retain their high value during economic downturns, even when other assets decline sharply. That’s why it’s wise to hold positions in silver bullion, silver mining stocks or silver ETFs.

Some millennials prefer to invest in silver ETFs and stocks over physical bullion when diversifying their portfolio. The demand for silver from other industries, such as tech, automotive, and renewable energy, is steadily increasing, driving up silver prices. As a result, silver ETFs can help diversify your portfolio and cut losses during a stock market correction.

For future generations

If you buy silver coins or bullion, it’s a transferrable asset that will retain its value; older groups can pass on the silver to the next generation. Sold in pawn shops, coin dealers, and banks, silver coins will always have a value that you can pass on to your children and family members.

Inevitable demand

Like gold, people will always want silver, especially as companies and governments begin exploring its many uses in sustainable technologies. Solar panels, electric vehicles, medical devices: all these instruments require silver to function. All of this guarantees that there will always be a market. Even small amounts of silver provide value and will serve as a cornerstone of your portfolio — and like gold, silver bullion has high liquidity and can be sold relatively easily.

Ways Millennials can invest in precious metals

Silver Bullion

Buy the physical metal — For those unfamiliar, this implies buying the actual metal — purchasing coins, bars, etc., in gold or silver. As a result, you now have a tangible asset you own outside the established financial system. Additionally, it eliminates investing’s counterparty risk. Simply put, this means that the failure of one party to fulfil their obligations puts other investments at risk.

A solid understanding of the metal’s current spot price at the time of purchase is necessary when purchasing real metal. It could be challenging to recover your initial investment if you pay an excessive premium for the actual gold.

Invest in an Exchange-Traded Fund (ETF) for Precious Metals

The constraints of purchasing physical silver are the major drawback of investing in bullion, as having a secure place to store the metals isn’t always viable. Exchange-traded funds (ETFs) are a desirable choice as a result. Liquidity is the main benefit of investing in precious metals through an ETF. Your brokerage account allows you to buy and sell shares. It’s practical and typically more affordable.

However, the fact that you don’t own the physical metal and have no claim to the metal held by the fund can be a drawback for some.

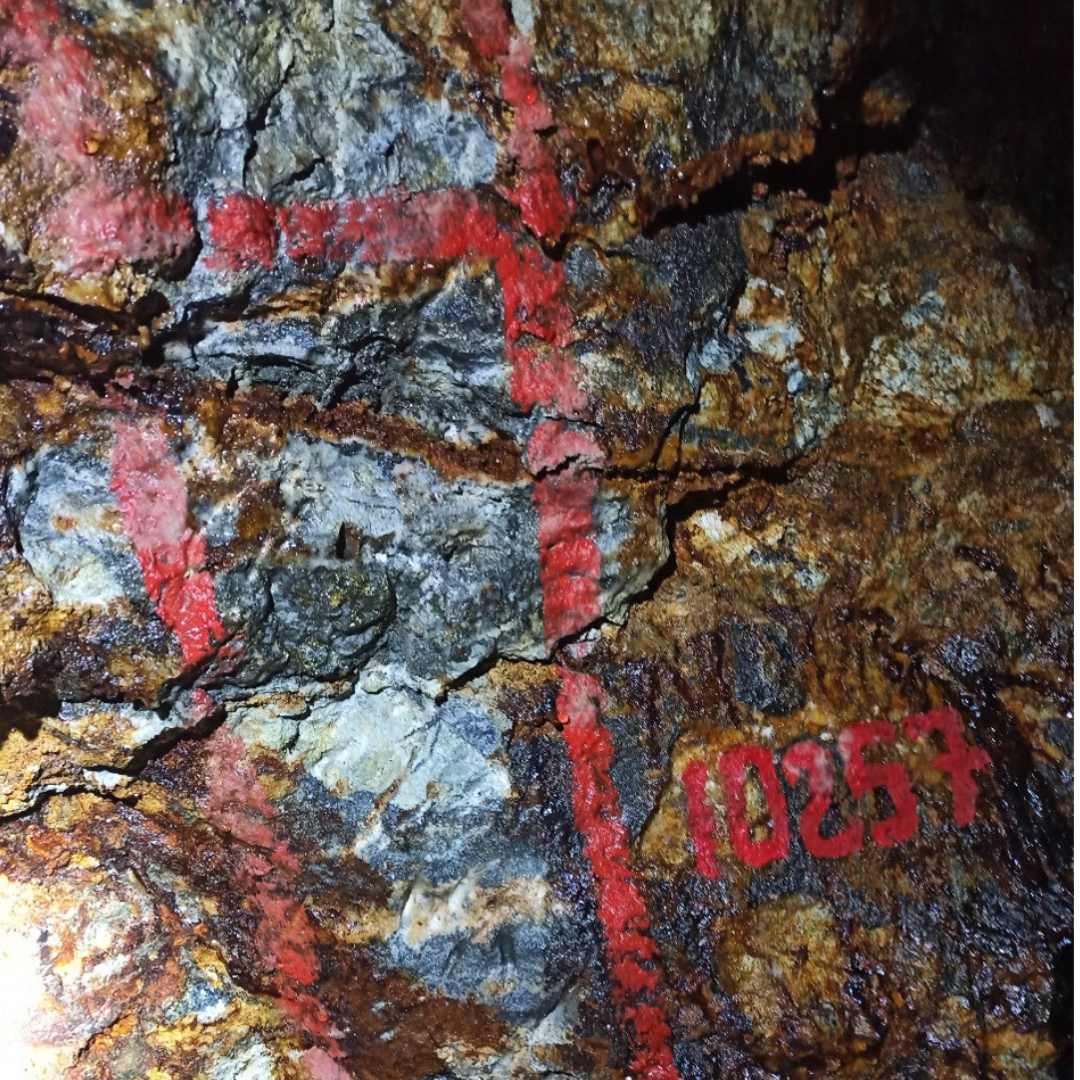

Purchase Silver Mining Stocks

Purchasing shares of businesses engaged in precious mining metals is a third option. A “picks and shovels” approach to precious metal investing is this. You are not, however, claiming ownership of the actual metal, much like when you buy in an ETF.

Futures Trading

With retail investors, options trading has become incredibly popular. The same is true for precious metals. However, the risk of losing your entire investment must be considered while weighing the potential reward of an outsized gain, as is the case with all options trading, which is contrary to investing in precious metals.

Bottom Line

Start slow if you’re new to the world of precious metals investing. The rhetoric surrounding buying precious metals is very emotional. However, if you invest in this asset class, you can detach emotion from your investment choices. Your unique situation will determine the precise allocation you receive. You risk missing out on profits available in other asset classes if you invest too much in precious metals. However, having too little or no exposure to precious metals can expose your portfolio to more risk than is prudent.

Source:

https://news.cleartax.in/why-do-millennials-prefer-investing-in-silver-etfs/7579/

https://orionmetalexchange.com/why-millennials-should-start-investing-in-precious-metals/

https://www.usgoldbureau.com/news/five-reasons-millennials-invest-gold-2017